Which of the Following Best Describes Supply Side Economics

What is supply-side economics AP Gov. B reducing tax credits for research and development.

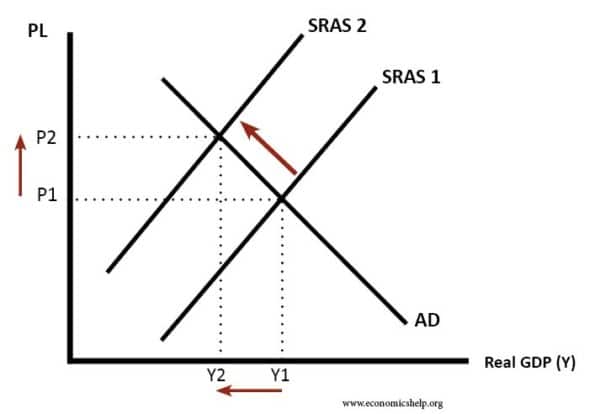

The Role Of Supply Side Policies In A Recession Economics Help

The correct answer is D.

. Supply-side economics is the theory that says increased production drives economic growth. C price stability low government budget deficits. 3 Which of the following would decrease the tax wedge.

It typically concerns what the outcome of an economy or what public policy ought to be. The impact of budget deficits on interest rates and aggregate demand. Added 3 days ago4112022 30815 PM This answer has been confirmed as correct and helpful.

Its tools are tax cuts and deregulation. A Labor productivity affects aggregate supply. The money supply shifts right the interest rate rises investment decreases and the aggregate demand curve shifts left.

E businesses reach decisions. B Education affects labor productivity which affects aggregate supply. A to organize production so that scarcity does not occur.

Up to 256 cash back A proponent of supply-side economics would advocate. Lower taxes on research and development of new technology. 1 Which of the following best describes supply-side economics.

The impact of government spending on aggregate demand output and employment. Which of the following best describes supply-side economics. Also known as Reaganomics supply-side economics cut taxes on the wealthy in order to stimulate investment in the economy and boost employment.

Education impacts labor productivity which impacts aggregate supply O C. C Labor productivity affects aggregate supply. 1 Which of the following best describes supply-side economics.

Economic growth resulting from tax cuts will make up for revenue lost by tax cuts. Education affects labor productivity which affects aggregate supply. C Education affects the incentive to work save and invest and therefore aggregate supply.

The factors of production are capital labor entrepreneurship and land. Tax rates affect the incentive to work save and invest and therefore aggregate supply O B. Labor productivity impacts aggregate supply O D.

D to create incentives so that scarcity does not exist. Normative economics is the idealized part of economics that encompasses value judgments about economic fairness. Supply-side economics is a macroeconomic theory arguing that economic growth can be most effectively created by lowering taxes and decreasing regulation by which it is directly opposed to demand-side economics.

Which one of the following statements is correct under the theory of supply-side economics. Education impacts the incentive to work save and invest and. Which of the following best describes supply-side economics.

What best describes why the price of wheat might rise following a poor wheat harvest. Labor productivity affects aggregate supply. A Education impacts the incentive to work save and.

When the supply is low the price is high and vice versa. Supply-side economics is an economic theory that postulates tax cuts for the wealthy result in increased savings and investment capacity for them that trickle down to the overall economy. Economic policy of shielding an economy from imports.

Which of the following best describes the Keynesian approach to economic policy. The correct answer is C. The simplest answer is the law of supply and demand.

Which of the following best describes supply-side economics. B Tax rates particularly marginal tax rates affect the incentive to work save and invest and therefore aggregate supply. Supply-side fiscal policy focuses on creating a better climate for businesses.

Lower taxes on businesses results in the expansion of industry. Transfer payments increase incentives to work. The impact of budget deficits on the rate of taxation in the future.

Increases in social security taxes and other business taxes shift the aggregate supply curve to the right. A low rate of bank failures high reserve ratios price stability and economic growth. C eliminating the depreciation allowance.

High marginal tax rates severely discourage work saving and investment. The money supply shifts right the interest rate falls investment increases and the aggregate demand curve shifts right. 2 The tax wedge is the difference between the A pre-tax and post-tax returns to an economic activity.

An economic theory advocated by President Reagan holding that too much income goes to taxes so too little money is available for purchasing and the solution is to cut taxes and return purchasing power to consumers. The impact of marginal tax rates on aggregate supply. Which of the following best describes supply-side economics.

Supply-side economics best fits the following statement. A Labor productivity affects aggregate supply. B firms make profits.

A Education affects labor productivity which affects aggregate supply. The supply-side fiscal policy offers incentives to the producers Ask a question. C Education affects the incentive to work save and invest and therefore aggregate supply.

A reducing income taxes on saving. Which of the following best describes supply side economics. The money supply shifts right prices rise demand curve shifts left.

C we make choices in the face of scarcity. B price stability high employment economic growth and stability of financial markets and institutions. B Education affects labor productivity which affects aggregate supply.

5 Which of the following best describes supply-side economics. Reagan also confronted unionized air-traffic controllers and deregulated the.

Demand Side Vs Supply Side Economics Theories Differences Video Lesson Transcript Study Com

/Supplyrelationship-c0f71135bc884f4b8e5d063eed128b52.png)

/supply_curve_final-465c4c4a89504d0faeaa85485b237109.png)

Belum ada Komentar untuk "Which of the Following Best Describes Supply Side Economics"

Posting Komentar